In this post, I want to look at funding, particularly via angel investing, of Wisconsin biotech companies over the last few years. On the national scene, Bruce Booth of Atlas Venture suggested in early 2013 that the number of new biotech startups is down and “worth watching closely”. In March, Luke Timmerman of Xconomy wrote about the decrease in the number of active VC firms, indicating there were only a dozen or so early stage biotech VCs funds left. On the plus side, OrbiMed Third Rock, Atlas Venture, and Frazier Healthcare have raised new funds and Versant and 5AM Ventures have announced they are raising.

(For more detail on the national scene, the Halo Report (Silicon Valley Bank) and a report on life science from Pricewaterhouse Cooper (PwC) provide a look at angel and VC funding environments.)

I’ve heard from a variety of Wisconsin stakeholders that there aren’t as many young biotech companies because local investors aren’t funding new companies. While my conversations are anecdotal, there was a report out from the Wisconsin Economic Development Corporation (WEDC) in June 2013 that quantifies the concern using certification for Qualified New Business Venture (QNBV) status.

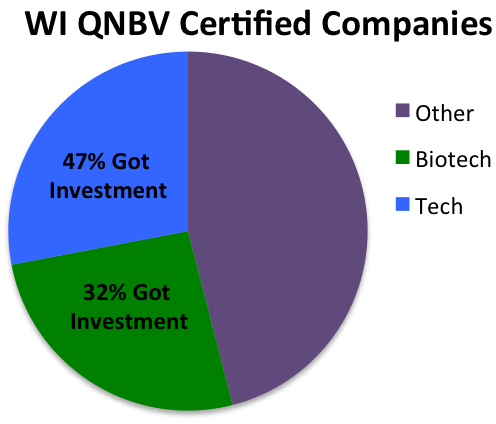

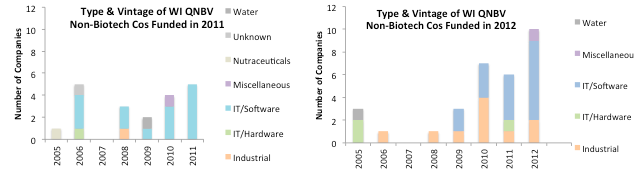

In the last few years the information technology industry has grown to the same level or slightly above the biotechnology industry in the total amount of qualified investments received on an annual basis. In addition, the number of new businesses certified has declined over time for the biotechnology industry, while there has been recent growth in the number of new information technology businesses certified. (page 9)

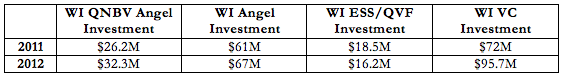

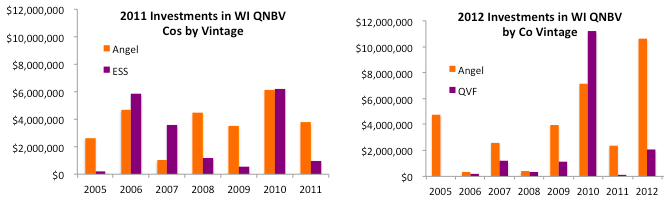

The Wisconsin QNBV program, also referred to as Act 225, provides a 25% tax credit to eligible investors for their investment in QNBVs. The goal of the program is to encourage investment in companies with the potential for significant economic and employment impact, which results in technology criteria for certification. Over the last two years, approximately 45% of the angel investment reported from Wisconsin was invested in QNBV certified programs. Less than a quarter of the venture capital invested in Wisconsin came through the Qualified Venture Funds (also referred to as Early Stage Seed (ESS)).

Data from WEDC 2012 Annual Report and Wisconsin Portfolio 2013.

From the start of the QNBV program in 2005 through the end of 2012, $58.8 million in tax credits have been distributed. The data from the start of the program suggests a pent up demand for biotech company applications as they made up a large share of the certified companies and initially invested capital. Historically, biotech companies have required far greater capital than technology companies and the local investment community may choose to invest in fewer biotech opportunities due to longer business cycles.

Throughout this post, I use a “big tent” definition of biotech but try to provide data for specific subsectors when possible.

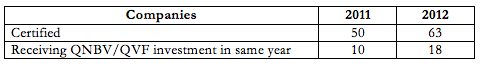

Data from WEDC 2012 Annual Report.

QNBV certification is not a measure of the quality of an entrepreneur or a business plan. Some percentage of certified companies should be expected to fail to raise investment dollars. According to WEDC (personal communication), the Wisconsin Department of Commerce and WEDC certified 227 businesses through the end of 2012 and 144 (63.4%) of those businesses received investments that qualified for tax credits. A lower success rate for biotech companies may reflect a longer history with the local investment community.

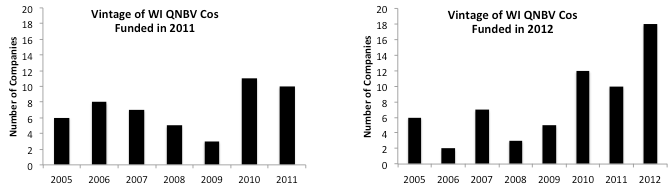

The graph that causes the most concern is likely this one, showing that over time, new biotech businesses have a more challenging time raising money in the year they were certified while tech companies had greater success. One of the reasons for such a trend could be that the investors in the biotech companies from the 2005 era are still holding (and supporting) those investments.

Data from WEDC 2012 Annual Report.

Of five biotech companies certified in 2012, only one received credits (20%) while twenty tech companies were certified and 9 of those companies were given credits (45%). To explore whether biotech is an outlier, I compiled the overall data from the 2011 and 2012 QNBV classes. Looking at the data, another feature was interesting: how much of the money invested in a given year was in new companies. In 2011, ~15% of the QNBV dollars ($3.8M of $26.2M total) was invested in newly certified companies. Only ~5% of the ESS funds were invested in the 2011 class ($0.97M of $18.5M total). In 2012, the investments in the 2012 class went up to ~33% QNBV ($10.6M of $32.2M total) and ~13% QVF ($2.1M of $16.2M total).

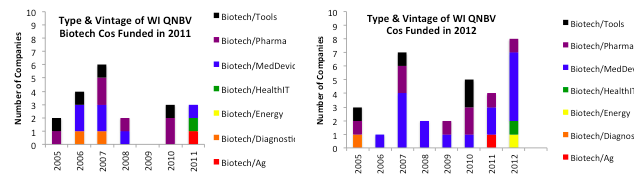

The data above suggests investors are providing significant funding to already existing QNBV companies, regardless of the type of company. Plotting the vintage of the certified companies funded in 2011 and 2012 supports that narrative. In both cases, investments were made in companies certified in each of the last eight years.

Investors are continuing to provide support to companies from each year of certification. While these dollars aren’t tracked as initial vs. follow-on, the likelihood is that the majority of funds more than a year out from QNBV certification are follow on rounds.

What Does the 2011 and 2012 Data Show about Biotech in Wisconsin?

Continuing with the 2011 and 2012 data, I segmented biotech companies into seven main categories and looked at funding activity. This categorization is different than the WEDC process as their report indicates only 1 of 5 biotech companies certified in 2012 was funded in 2012.

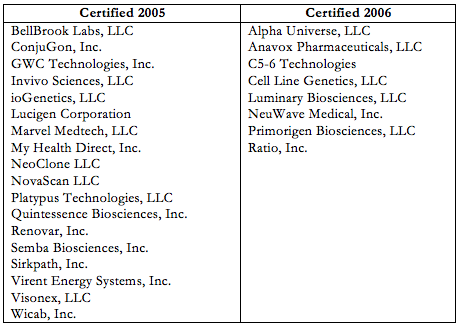

Overall, the data shows support from investors to companies that started in the QNBV program eight years ago. This support can be viewed as a positive or a negative. From a company perspective, follow on financing is critical. However, at some point the investor base needs exits in order to infuse capital into new companies. Looking back at the 2005 and 2006 certifications for biotech companies, over 60% of biotech companies from that time are still private companies. Some of these companies are breakeven or profitable. Even if no additional funding is needed, capital invested to date has likely not been returned to shareholders.

- Of 29 biotech companies QNBV certified in 2005

- 4 acquired/merged/public

- 18 ongoing

- 7 no longer active

- Of 12 biotech companies QNBV certified in 2006

- 1 acquired/merged/public

- 8 ongoing

- 3 no longer active

While there is a need for these investors to find the exits to support new companies, two of the 2006 class, NeuWave Medical ($14M) and Cellular Dynamics ($21M) raised about one third of the total venture capital investment in Wisconsin in 2012, indicating external capital is still potentially available for this vintage of biotech company.

How Will the Next Generation of Biotech Companies Be Funded?

Given the long investment cycle in biotechnology, the Wisconsin biotech community could use an influx of new investment capital to fund new company formation while existing companies can find the exits. Recent moves to fun innovation in Wisconsin have focused primarily on technology, presenting a challenge for local biotech startups but potential opportunity for outside capital.

On the technology front, SWIB and WARF have partnered to launch a fund called 4490 Ventures. The recent state-funded venture effort in Wisconsin is applicable to a subset of the biotech industry. A New York fund has committed to investing $500,000 over next three years in early stage companies that come out of UW-Madison. This program expands their presence beyond existing investments in four Madison tech companies.

So where will the funding come from to support the next generation of biotech companies? One possibility is to tap existing infrastructure. In Wisconsin, the biotech community has strong history in contract research, medical devices and life science tools and there is a strong employment base. Two years ago, the Wisconsin Next Generation Jobs Act was introduced that would build a fund using a portion of payroll taxes from new biotech industry jobs in Wisconsin. While the measure wasn’t successful, the concept provides an alternative to traditional government approaches.

I believe new funds with a WI biotech investment focus are unlikely so that the next wave of biotech innovation in Wisconsin will require better connections, internally and externally to existing and potential investors. I also believe that investing, particularly in early stage companies, is a people driven business. One of the questions I keep asking myself is: how do we build more, stronger bonds efficiently?

Postscript 1:

In 2011, IT/software company investments included 2006 vintage companies (NovaShield, TrafficCast, Networked Insights).

Postscript 2:

The following lists provide the status of biotechnology companies certified as QNBV in Wisconsin in 2005 or 2006. [Send updates or include in comments if applicable.]

Acquired/Merged/IPO

- AquaSensors LLC (certified 2005)

- BioSystem Development, LLC (certified 2005) – Acquisition by Agilent

- Cellectar, Inc. (certified 2005) – Acquisition by Novelos

- Cellular Dynamics International, Inc. (certified 2006) – IPO

- Nerites Corporation (certified 2005) – Acquisition by Kensey Nash, then DSM

No Longer Active

- aOva Technologies, Inc. (certified 2005)

- Caden Biosciences, Inc. (certified 2006)

- eMetagen Corporation (certified 2005)

- GenTel BioSciences, Inc. (certified 2005)

- Keelate Laboratories LLC (certified 2005)

- Kenergy, Inc. (certified 2006)

- MatriLab, Inc. (certified 2006)

- Mithridion, Inc. (certified 2005)

- NeuroGnostics, Inc. (certified 2005)

- PointOne Systems LLC (certified 2005)

Active

Pingback: 3 life science companies that are built to last | Knowledge Strategies & Bioscience