The fourth quarter venture capital investment numbers came out, which prompted me to update the biotech investment numbers as well as the Wisconsin VC numbers. As I was looking at the data, I was reminded that for a place with few VC dollars such as Wisconsin (<$100M per year across industries) we need to evaluate the other sources of equity funding. (I updated this figure relative to my July 2011 version to include the possibility of crowdfunding.)

My takeaways from the data I could find were:

- Wisconsin has a good environment and the capital to seed and grow companies.

- WI angel investment reported by the state angel network was $50.2M in 2010 and $61M in 2011.

- While state numbers aren’t in, Capital Entrepreneurs, a Madison based group, surveyed their member companies and found that $10.6M was invested in 2012 across approximately 30 companies. See the discussion below for greater insight on this data.

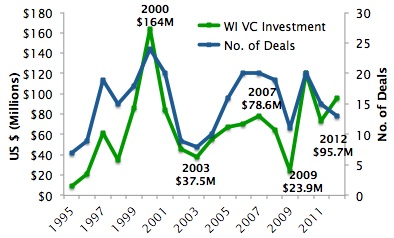

- Venture investment in the state has rebounded from the 2009 low of $23.89M to $95.7M in 2012, which is higher than the 2001-2008 funding levels.

- The state needs out-of-state capital to take companies through the full funding cycle.

- The double digit million dollar VC rounds all involved relatively established companies and involved significant out-of-state capital.

- There are some interesting approaches to leveraging VC dollars invested in Wisconsin companies.

- Access to the large capital sources requires long distance relationships.

- Since this part of the topic gets to some of the softer side of investing, I covered this topic in a separate post.

The Scale of WI Angel Investment

The state often provides an overview of angel investment in Wisconsin toward the end of the first quarter of the following year. I am not sure of the exact source of the numbers but from what I can gather the estimates are less than the actual dollars invested. (I’m working on greater clarity on this methodology.) The state reported angel investment in Wisconsin at $50.2M in 2010 and $61M in 2011.

The Capital Entrepreneurs is a Madison based group of entrepreneurs from a variety of industries, although there is a heavy tech presence. About thirty of their member companies responded to a survey about 2012 accomplishments and

“The number and impact of startups within the Capital Entrepreneurs community continued to grow, and many of those startups saw a lot of success. In 2012, Capital Entrepreneurs companies created over 125 full time jobs, raised $10.6 million in funding, and produced multi-million dollar revenue streams.”

Comparisons are a challenge since results are self-reported and respondents vary year to year. However, the results for 2011 were 121 full time employees hired and $23.7 million in funding. While 2012 initially looks like a decrease, the 2011 funding was dominated by a single large financing ($20M in an institutional round) while the 2012 number was a moderate numbers from a broader distribution of companies (personal communication with Capital Entrepreneurs).

Solid VC Numbers from Wisconsin

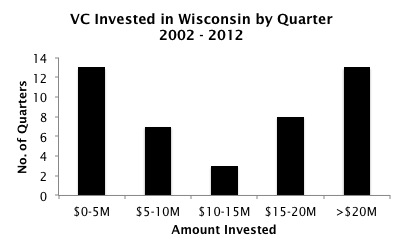

PricewaterhouseCoopers and the National Venture Capital Association recently released their fourth quarter venture capital data. Since the overall numbers of VC dollars and deals in Wisconsin are low, I’ve historically provided the aggregate data across industries. The data suggest that Wisconsin is making progress in bringing venture capital investment dollars into the state. The $95.7M raised in 2012 was a rebound from the 2009 low of $23.89M and is higher than the 2001-2008 levels. The second graph, VC Invested in Wisconsin by Quarter continues to show that dismal funding quarters are generally balanced out by active quarters. In other positive WI VC news, Venture Investors, the venture capital firm based in Madison had a first close on their newest fund in 2012.

Getting to Double Digit Million Dollar VC Investment

I tracked down five double digit million dollar venture capital rounds in Wisconsin in 2012. These rounds all involved relatively established companies and involved significant out-of-state capital. The deals below total $107.4M, which is higher than the PWC/NVCA total. I will update the post if I can get additional clarity on which of these deals was not in that data set.

- Nordic Consulting, a company that focuses on Epic software implementations, upgrades, and optimization, raised ~$41M in a round that included three large healthcare investment companies: SV Life Sciences, HLM Venture Partners, and HEP. According to the company, they are the largest Epic-only consulting firm in the country.

- NeuWave, a Madison-based medical device company, brought in $14M in September in a round that was led by a new investor, H.I.G. BioVentures. The company has already raised over $10M from an apparent mix of institutional and individual equity financing.

- Shoutlet, which provide companies with a platform for social marketing, raised $15M from a new investor, FTV Capital out of San Francisco and Manhattan. Prior to this round, Shoutlet had raised $9.2 from investors that included one of their customers, American Family Insurance.

- Cellular Dynamics, a company that has focused on induced pluripotent stem (iPS) cells as research tools, raised an additional $21M from Tactics II Investments. I’ve mentioned previously that the founder and principal Tactics II Stem Cell Ventures is also CEO at Cellular Dynamics. Even if this investment was counted as a different type of private equity investment, the overall total would remain slightly up relative to 2011.

- CalStar Products, a company that makes green masonry products, raised $22.21M from EnerTech Capital, Foundation Capital and Nth Power LLC. (The only non-Madison company on the list, CalStar is located in Racine Wisconsin.)

Leveraging VC Dollars in Wisconsin

In May of 2012, the Kauffman Foundation came out with a report on the state of the VC market called “We Have Met the Enemy… And He is Us”. The discussion focused on the relationship between general partners (GPs) and limited partners (LPs) and one of the recommendations in the report was that LPs invest directly into portfolio companies. Bruce Booth, a VC from Atlas Venture, cautioned that LPs should consider making direct investments alongside trusted investors. The suggestion caught my attention because a Wisconsin-based LP, the State of Wisconsin Investment Board, has had side-by-side commitments since 2002. SWIB is able to make these investments with just two firms that have been active Wisconsin funders (Baird Venture Partners and Venture Investors). One of the recent (May 2012) co-investments was with Baird Venture Partners in a $6.2M financing for Zurex Pharma, a Madison-based company with a novel antimicrobial technology platform. Extending these partnerships to other VCs that invest in Wisconsin could be an exciting opportunity for local companies.

Addition 23 January 2013: In 2012, American Capital, a private equity (PE) firm, bought out the previous PE owner of Cambridge Major Laboratories, a Germantown-based company that manufactures drugs. The reported deal value was $212M.

Pingback: Investing in Long Distance Relationships in Wisconsin | The Next Element

Pingback: Sanofi R&D: Open Inovation…and Networks | The Next Element

Pingback: WI VC Investment: Down (& Out?) in Q3 ’13 | The Next Element

Pingback: Early Stage Biotech Investing in Wisconsin: Hot or Not? | The Next Element

Pingback: Weekend Reading List 2/15/14 | The Next Element