Engine and Kaufmann Foundation recently published a report called “Tech Starts: High-Technology Business Formation and Job Creation in the United States”. While most of the report focuses on job creation by high-tech relative to other private sector businesses, I was particularly interested in the determination of high-tech startup density across the country. The author used both publicly available and custom data from Census Bureau about the high-tech sector. According to the Census Bureau, the high-tech sector includes pharmaceutical and medicine manufacturing, aerospace products and parts manufacturing, architectural, engineering and related services and scientific research-and-development services as well as ten industries related to information and communications technology (ICT). The authors then determined high-tech startup density by:

“As a measure of startup density, we calculate location quotients for new high-tech and ICT firms. The location quotient measures the concentration of high-tech or ICT startups in a region relative to the average across the entire United States. More specifically, it places the ratio of high-tech (or ICT) firm births in a region to the population in the same region in the numerator, and that same ratio for the entire United States in the denominator. Values of one indicate that a region has the same density of startups as does the United States as a whole. Density measures greater than one indicate above average densities. The opposite is true for values less than one.”

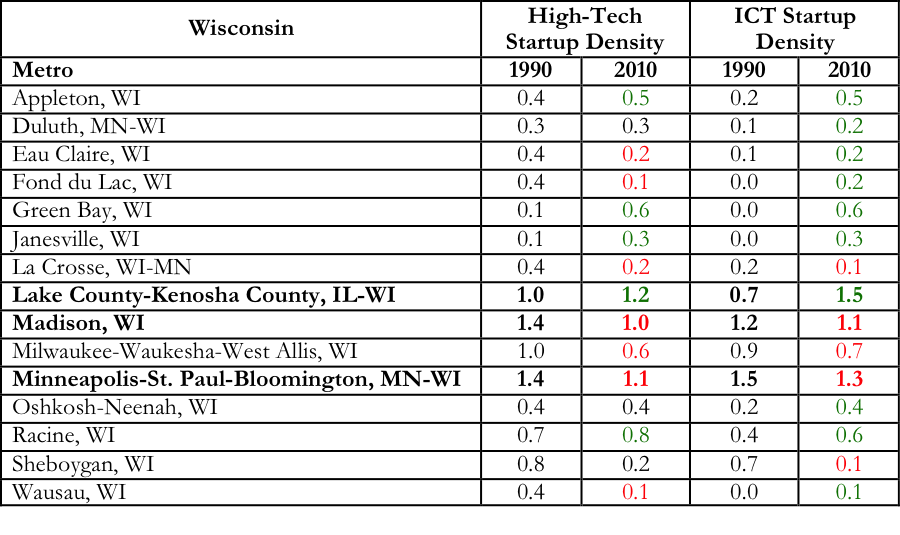

The report lists the top 20 metro areas by high-tech startup density in 2010. To provide a baseline for the Wisconsin data, I’ve included the historical data for the high-tech as well as the ICT startup density in the table below. I’ve colored the 2010 numbers based on growth (green) or loss (red) between 1990 and 2010.

The data for the fifteen metro areas associated with Wisconsin are provided below.

- Two of the three WI associated metro areas with startup density greater than 1 are associated with large cities in other states. Lake (IL) and Kenosha (WI) counties are on the north end of Chicago.

- The remaining metro area, Madison, appears to have lost ground over the last twenty years.

Is the Madison experience typical? The high-tech startup density of seventeen of the top 20 metro areas grew over the last twenty years (see above). Overall, the number of metro areas with high-tech startup density greater than one grew from 1990 (67) to 2010 (78).

With more metro areas moving up in high-tech startup density, is Madison keeping pace with high-tech development across the country? In my opinion, the importance of the answer likely has to do with the other part of the report – the jobs these companies create. The report didn’t break that data out but I would be very interested to see that.

Should this metric be geographically weighted? Meaning, the coasts have always been more attractive for tech than the Midwest, so should we expect Madison to keep pace with the coastal metro areas?

Seeing alternative analyses could help determine whether there should be categories for size, geography, etc.

One of the main stumbling blocks for me in terms of a weighting factor has been the presence of small, non-coastal metro areas in the top twenty – Cheyenne WY (population ~60,000), Missoula MT (~67,000), Sioux Falls SD (~157,000) and Ames IA (~60,000). Those areas were all growing in HT startup density as well.

Should Madison (~240,000 with ~490,00 in Dane County) compete without weighting relative to those areas?

Agreed, more data is needed to truly understand Madison’s positioning in the high-tech startup landscape. Also, segregation by industry would be helpful. Cheyenne, for instance, ranks higher in information and communication technologies than it does in biotech.

Ultimately, we have to understand what these cities are doing to spur innovation and foster entrepreneurs? There’s a piece on Inc.com (http://www.inc.com/eric-markowitz/startup-density-of-the-united-states.html) that briefly addressed this question.